Securities firms are most often used by money launderers to conceal illicit funds and finance criminal activities. This illicit practice poses significant threats to financial stability and global security. In this article, we delve into the role of securities firms in facilitating money laundering, examining the methods employed by criminals and the red flags that indicate suspicious activity.

We also discuss regulatory measures and best practices to combat this pervasive crime.

The second paragraph provides a comprehensive overview of the topic, outlining the key points and highlighting the importance of understanding the risks associated with securities firms and money laundering.

1. Securities Firms and Money Laundering: Securities Firms Are Most Often Used By Money Launderers To

Securities firms, including brokerage houses and investment banks, play a significant role in facilitating money laundering activities due to their ability to transfer large sums of money quickly and anonymously.

Methods and Procedures Used by Money Launderers

- Structuring: Breaking down large transactions into smaller ones below the reporting threshold to avoid detection.

- Shell companies: Establishing fictitious companies to conceal the true ownership and source of funds.

- Layering: Moving funds through multiple accounts and transactions to obscure the origin and destination.

- Trade-based laundering: Using international trade transactions to disguise the movement of illicit funds.

2. Types of Securities Firms Used for Money Laundering

Most Targeted Firms

- Brokerage houses with lax KYC (Know Your Customer) procedures and minimal due diligence.

- Investment banks with offshore branches or subsidiaries in jurisdictions with weak anti-money laundering regulations.

- Online trading platforms that offer anonymity and ease of account opening.

Reasons for Vulnerability

- High volume of transactions, making it difficult to identify suspicious activity.

- Lack of transparency and regulatory oversight in certain jurisdictions.

- Potential for conflicts of interest between firms and clients.

Case Studies, Securities firms are most often used by money launderers to

- Operation Green Quest: A multi-jurisdictional investigation that uncovered a money laundering scheme involving brokerage houses in the United States, Europe, and the Caribbean.

- Panama Papers: The leak of confidential documents from a Panamanian law firm revealed the use of shell companies and investment banks for money laundering purposes.

3. Red Flags for Money Laundering in Securities Firms

Indicators of Suspicious Activity

- Large and frequent cash transactions.

- Clients with no clear economic rationale for trading activities.

- Transactions involving high-risk jurisdictions or entities.

- Unusual trading patterns or large unexplained profits.

- Clients using multiple accounts or nominee arrangements.

Monitoring and Detection

- Establishing robust KYC and due diligence procedures.

- Implementing transaction monitoring systems to identify suspicious patterns.

- Training staff to recognize and report red flags.

Response and Investigation

- Reporting suspicious transactions to regulatory authorities.

- Conducting internal investigations to gather evidence.

- Freezing or closing accounts involved in money laundering activities.

Question Bank

What are the common methods used by money launderers to exploit securities firms?

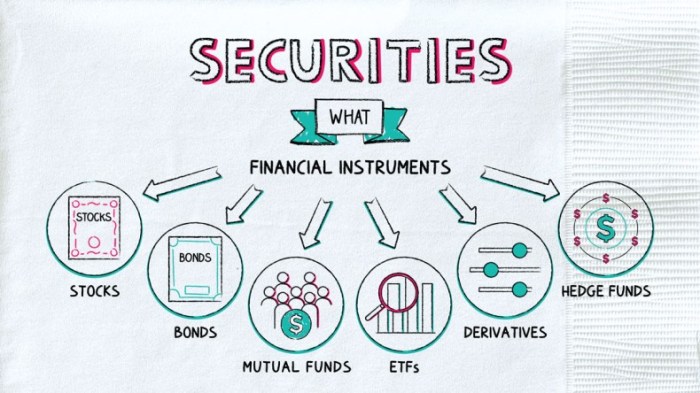

Money launderers often use securities firms to purchase and sell stocks, bonds, and other financial instruments. They may also use these firms to transfer funds between accounts or to create complex financial structures to conceal the origin of illicit funds.

What are the red flags that may indicate money laundering activity in securities firms?

Red flags include large or unusual transactions, frequent account turnover, and transactions that do not appear to be related to the client’s business or investment objectives.

What regulatory measures have been implemented to combat money laundering in securities firms?

Regulatory measures include customer due diligence requirements, transaction monitoring systems, and reporting suspicious activities to financial intelligence units.